Property Market News

Thatcher’s Dream Smashed as Homeownership in Leicester Drops

In her first conference speech as the Tory’s new leader in 1975, the grocer’s daughter from Grantham, Margaret Thatcher, asserted her conviction in a ‘property-owning democracy’.

Although Thatcher didn’t conceive the saying – (that credit belonged to Conservative MP Noel Skelton in 1923), it encapsulated what she thought Britain should be.

Through prudence, saving and hard work, she believed that everyday British families should be able to purchase their own homes. Thus giving them security, self-esteem and independence and freeing them from the nanny state of local authority landlords.

Although that idea was a Labour idea initially in the mid-1970s, Margaret Thatcher introduced legislation (Right-To-Buy) in 1980 to allow local authority tenants to buy their own council homes at significant discounts. In the 1980s, homeownership boomed (although it had been on the increase for the previous two decades), and she led the country in economy with which house buying became a national passion.

Between 1981 and 1990, home ownership went up

from 11.88m to 15.47m.

The other lesser-known fact of the Right-to-Buy legislation in 1980 was it stopped local authorities from building new council houses.

Fundamental to her idea was that government (central or local), which had built between 30% and 45% of all homes in the 1950s, 60s and 70s, should stop providing homes and let the market provide them.

The proportion of homes owned rose from 55.4% in 1980

to 65.7% during Thatcher’s reign as PM.

A few days ago, the housing element of the 2021 Census was released, and it has shown the proportion of home ownership had fallen to its lowest level since 1985.

The proportion of households owned in the country fell from 64.1% to 62.5% between 2011 and 2021, the lowest level for the past 37 years, when the figure was 61.6%.

In the meantime, the proportion of privately rented households has surged to its highest since the late 1960s, with 20.4% of households renting from a private buy-to-let landlord.

This means the proportion of British households in private rented accommodation has more than doubled in the past two decades, from the 9.5% recorded in the 2001 census.

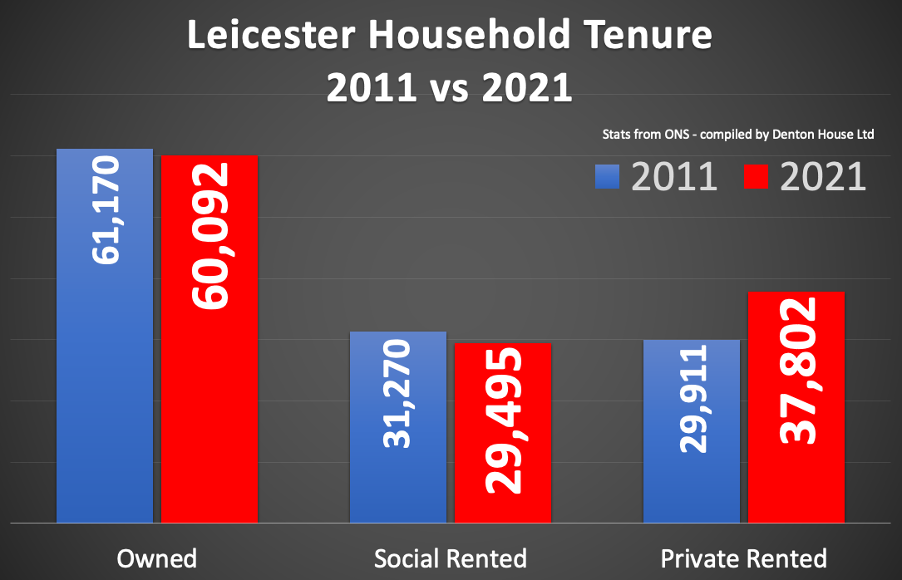

So, let’s look at the local stats for the Leicester council area.

The percentage of households owned in Leicester has

dropped from 49.7% in 2011 to 47.2% in 2021.

Putting that into numbers …

The number of owned households in Leicester has dropped from 61,170 in 2011 to 60,092 in 2021, a drop of 1.8%.

So, what has happened to the number of privately rented accommodation locally?

The number of privately rented households in Leicester has grown from 29,911 in 2011 to 37,802 in 2021, a rise of 26.4%.

Over the coming weeks and months, I intend to drill down further into these stats nationally and locally.

Even though homeownership has increased in terms of pure numbers, the proportion of homeowners with a mortgage has dropped.

Just some headlines to whet your appetite.

As I said above, 64.1% of householders in Britain owned their own home in 2021 (of which 30.8% owned their home outright and 33.3% with a mortgage).

In 2021, of the 62.5% of homeowner households, those without a mortgage has increased to 32.8%, and those with a mortgage has dropped to 29.7%.

So, has Thatcher’s dream been smashed?

Of course, nationally, home ownership is at the lowest level in many decades due to several factors, including the late 1980s and 2008 housing crash, negative equity, the credit crunch and increased mortgage regulation.

Yet, at the same time, as every single local authority in Britain has seen an increase in the number and proportion of private renters over the past 20 years, the entrepreneurial property-owning spirit has moved into the ownership of private buy-to-let property. The market has undoubtedly filled the housing gap that the councils and local authorities left in the 1980s.

These are interesting times, and I shall share more insights in the coming weeks and months.

Let me know your thoughts on the information above.